Restructuring Energy Resources in Puerto Rico

In the aftermath of Hurricane Maria, the entire island of Puerto Rico faced a power outage due to strong winds that damaged much of the energy infrastructure. [1] This devastation was compounded by Maria’s timing, as it hit only two weeks after Hurricane Irma, which had already left ⅓ of Puerto Rico’s three million residents without power. [2] The Puerto Rico Electric Power Authority (PREPA) is a public energy corporation and the most prominent electrical supplier in Puerto Rico, responsible for 80% of total electrical capacity and all distribution and transmission lines on the island but not generation. [3] Prior to the storms, PREPA had already been facing decades of financial troubles, making it difficult to update infrastructure and undergo extensive maintenance. By 2017, 85% of Puerto Rico’s power lines were incapable of withstanding a Category 4 hurricane. [4] The installation of an independent regulatory agency that can report on the efficacy of PREPA from an independent perspective could aid PREPA’s current governance through the ongoing process of financial restructuring. Thus, our proposal suggests ways to not only make infrastructure stronger for hurricane resiliency, but also for PREPA to regain stability for improved island energy supply and distribution, creating a stronger foundation for recovery efforts in the future.

In addition, Puerto Rico’s energy system is highly centralized and relies heavily on a few power plants fueled by imported fossil fuels. [5] We instead propose the use of microgrids, which are localized power grids powered by various resources that can connect and disconnect from a larger energy grid, throughout the island. Having localized grids would allow individual communities and regions to be electrically independent in case of emergency, which would minimize the chance that one malfunction or area of damage in the larger grid causes a massive blackout. [5] Additionally, increasing energy production on the island through renewable means like solar, wind energy, and biomass would reduce dependence on imports, which often get interrupted during a storm. [6] In regards to damage resistance, microgrids are only as resilient as the local infrastructure generating the power. Hardening current and new energy infrastructure with more resilient materials, such as reinforced concrete and metals, would ensure the safety of each microgrid and would minimize recovery efforts in future emergency situations.

In order to improve Puerto Rico’s resilience to natural disasters, the following strategies regarding its energy infrastructure might be considered: introduction of a regulatory private energy manager for PREPA, the main supplier of electricity on the island; conversion of the island’s power system to renewable-energy microgrids; and remodeling of the energy infrastructure using more resilient materials, such as concrete and metal.

Current State of Affairs

Puerto Rico’s population is mainly centered in the north around San Juan, with suburban populations along the coast and few people in the mountainous interior. However, many power plants are currently located in the rural areas in the southern part of the island, a result of tax incentives in the 1970s which led U.S. companies to build generation facilities there. [7] Twenty years later the tax incentives disappeared and so did the factories, but the generators still remain. [8] Now, energy has a long path to travel to reach most people, so it is much more susceptible to damage and failure. See Figure 1 below for the population and power plant distribution of Puerto Rico.

Energy infrastructure was already ailing before Hurricane Maria, which was largely influenced by the Puerto Rico Electric Power Authority, a public corporation which owns the distribution and transmission lines for electricity and supplies 85% of total electricity in Puerto Rico. PREPA’S forced outage factor, a metric describing the probability that a power unit will not be functional when needed, rose to 27% by the end of 2015. [9] And during these interruptions, the Puerto Rican power grid saw an average interruption duration of 16 hours. [8] In one significant instance in 2016, a major fire at a power plant caused an island wide blackout; [10] in June 2017, Puerto Rico’s generators were reported “28 years older than the U.S. average.” [11] Then Hurricane Irma hit, with only a two week period to repair the damage done before Maria. All in all, Puerto Rico’s energy infrastructure was unprepared to face Hurricane Maria.

After Maria, Puerto Rico experienced the longest and largest blackout in U.S. history (see figure 2 below). Since Irma, 1 million had been without power, but by the end of Maria, the island’s 3.5 million residents were left in the dark. [12] Restoring power was a long and arduous process, with 1.5 million still without power 100 days after the storm. [13]

Post storm, Puerto Rico took major political steps in order to address the damage. In early 2019, Puerto Rico approved the Energy Public Policy Act, which establishes the goal for Puerto Rico to be powered solely on renewable resources by 2050, and enforces new guidelines for solar power requirements for companies. The government agency PREPA is, as of 2019, attempting to privatize with the intentions of restructuring its debt and establishing more secure funding for future improvement of energy infrastructure throughout the island.

Definitions

Puerto Rico Electric Power Authority (PREPA): The Puerto Rico Electric Power Authority is a public corporation which owns the distribution and transmission lines for electricity and supplies 85% of total electricity in Puerto Rico. It does not receive money from the central government, but has the capacity to issue bonds.

Microgrids: A microgrid is a small electricity network generated from a local source that is distributed to only a few nearby people. Microgrids are usually connected to a larger, centralized grid, but they can disconnect and function independently when needed.

Integrated Resource Plan (IRP): A plan published by Siemens Power Technology International which includes data analysis and recommendations for a recovery plan for PREPA. In June 2019 the most recent draft was released and is currently still under review. This latest version of the IRP was geared toward helping PREPA shift toward renewable energy sources in order to meet Puerto Rico’s goal of using only renewable energy by 2050, and implementing both microgrids and MiniGrids.

Puerto Rico Energy Bureau: Founded in 2014, this bureau regulates, monitors and enforces compliance with energy public policy of the Government of Puerto Rico for PREPA.

Independent Private Sector Inspector General (IPSIG): An IPSIG employs an outside organization to monitor various aspects of a company’s management, financial proceedings, and processes, in order to give unbiased feedback and thus help the company meet its financial and organizational goals, and ensure transparency and efficiency.

Policy and Funding Suggestions

We have three main suggestions for promoting energy-resilient government policy around Puerto Rico.

- Introduce an independent regulatory agency to monitor the governance of the Puerto Rico Electric Power Authority (PREPA). [1]

- Hire representatives to oversee each microgrid and give regular updates on the maintenance of the microgrid and its effectiveness in meeting the needs of the assigned area.

- Consider the interdependencies between electric power and public networks (such as telecommunications) for combined infrastructure funding opportunities.

Energy Policy

The Puerto Rico Electric Power Authority (PREPA) is a public energy corporation and the most prominent electrical supplier in Puerto Rico, responsible for 85% of total electrical capacity and all distribution and transmission lines on the island. [2] PREPA is primarily governed by Puerto Rico’s central government, with six out of the seven PREPA board members being personally appointed by the governor — three of which do not need Senate approval — and one final member being elected by the Department of Consumer Affairs. [3] The Puerto Rico Energy Bureau is a separate organization founded in 2014 for the purpose of overseeing the management of PREPA and enforcing environmental and managerial regulations for the corporation. All recommendations made in this section will be made in regards to PREPA and the public grid overseen by PREPA since it supplies electricity to the majority of the island and has the broadest impact.

PREPA currently has $9 billion of hanging debt and is undergoing major organizational restructuring. [4] In addressing this, the agency has plans to privatize, selling pieces of the organization to multiple private companies, [5] and thus shifting the governance of PREPA from government officials to private shareholders. Puerto Rico underwent a similar process in the 1990s with the Puerto Rico Aqueduct and Sewer Authority, in which the previously public company with ailing infrastructure and increasing debt was sold in its entirety to a private corporation. Over an eight year period, the organization’s financial state remained largely the same, and in 2003 the company was returned to government control. [6] In order to prevent the same result, we recommend the installation of an outside regulatory agency to oversee the restructuring of PREPA, in regards to management, finances, and regulatory compliance, as it goes through the privatization process. Particularly, this agency may take the form of an Independent Private Sector Inspector General (IPSIG), as previously suggested by the Institute for Energy Economics and Financial Analysis (IEEFA) in 2019. An IPSIG employs an outside organization to monitor various aspects of a company’s management, financial proceedings, and processes, in order to give unbiased feedback and thus help the company meet its financial and organizational goals, ensuring transparency and efficiency. While the Puerto Rico Energy Bureau serves a similar purpose and aims to oversee the management of PREPA, an IPSIG would specifically address PREPA’s bankruptcy and would ultimately aid in the ambitions of the energy bureau. The Irrigation and Electric Workers Union (Utier) similarly advocates for the installation of an IPSIG in order to combat receivership, in which a trustee (the receiver) is appointed to oversee PREPA’s reorganization after filing for bankruptcy. An IPSIG, as compared to a receiver, would be “less intrusive and adversarial” according to Utier. [7]

Energy Funding

In regards to the solutions proposed in Proposed Alternative Energy Solutions, funding should be divided between repairing/reinforcing the existing power grid structure and investing in microgrids. The Build Back Better Report, released in December 2017, outlines a $17.6 billion recovery plan to restore and improve Puerto Rico’s electric infrastructure. In 2017, the Puerto Rico Energy Resiliency Group reported that $2 billion from the U.S. Dept. of Housing and Urban Development had been designated for energy grid repairs. FEMA had also allocated $2 billion to the US Army Corps of Engineers to execute the mission agreement for power restoration. Furthermore, as recommended by the U.S. Department of Energy, opportunities for combined funding through other distributive services, such as telecommunications, can be evaluated for joint funding for infrastructure repairs and updates. Telecommunication lines often shares utility poles and transmission towers with electrical distribution lines, and joint funding may spread the burden of distribution related energy infrastructure.

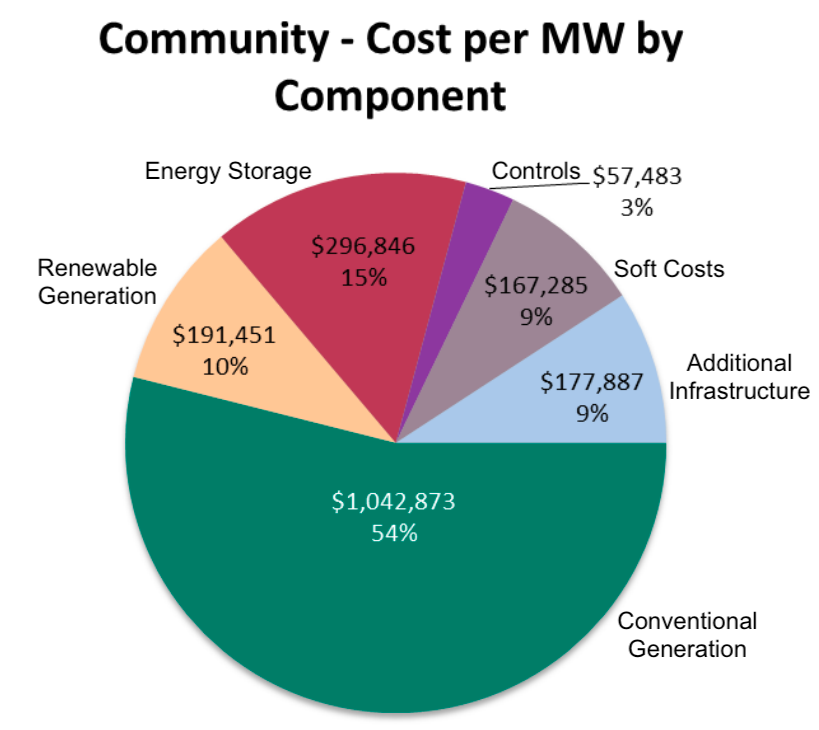

Community microgrids, which generally have a capacity of up to 5 MW and are made to power public services, cost a mean of $2.1 million/MW of distributed energy resources, which is relatively low compared to other markets such as utility or commercial microgrids. [8] Puerto Rico currently sees a peak energy demand of 3,685 MW. As the plan for microgrids supplements the implementation of MiniGrids by PREPA, microgrids would be responsible for approximately ¼ of this energy demand, or close to 900 MW, costing a total of approximately $1 billion. Across these markets, microgrid controller costs (per megawatt) range from $6,200 to $470,000, but tend to “decline generally as microgrids grow in size.”[8] However, recent developments in autonomous control have the potential to lower these costs further by “reduc[ing] the site-specific costs,” therefore making microgrids even more economically feasible for communities. Additionally, if implemented in essential agencies such as hospitals, “an intelligent hospital microgrid can monitor grid electricity prices throughout the day and switch to its own lower cost energy when grid prices spike, making it cheaper for hospitals in the long term”. [9]

Using Puerto Rico’s current GDP and comparing prices/power generation capabilities between petroleum and solar power — since PREPA’s Integrated Resource Plan and our proposed microgrid plan rely mostly on increased solar generation — replacing 1% of Puerto Rico’s current petroleum energy production with solar power would cost 0.02% of Puerto Rico’s current GDP. [10][11] Supplementing this, the installation costs of a new wind and WTE plant, as well as the reparations needed for the Punta Lima Wind Farm damaged by Hurricane Maria, would cost approximately $300 million. If new government tax incentives (in the form of credits, lower rates, or zero duties for a specific period) are enacted, private stakeholders can invest capital and technology, thus minimizing the government’s financial burden. [12]

Project Proposal Budget

| Project Proposals | Estimated Cost (USD) | |

| Independent Private Sector General | $300,000 | |

| Case study/trial run ranges: $1.43M to $3.33M | Average: $2.12M | |

| Utility poles and transmission towers | $150M | |

| Guy wire anchor | $4.49M | |

| Monopoles | $12.2M | |

| Total: | $569M |

Figure 5: The estimated cost of implementing all proposal related to energy infrastructure.